Bank fees, such as monthly maintenance or overdraft fees, also count. Interest paid on business loans, ongoing credit lines and business credit cards are tax-deductible expenses. A better bet: Minimize bad debt and increase cash flow by optimizing your billing processes. Any fees spent trying to collect on debt, such as hiring an outside company to collect what’s owed, also count. You can also deduct payments made to employees to reimburse them for relevant educational expenses.īusinesses that use accrual basis accounting, where revenue and expenses are recorded when they’re earned or incurred even if no money changes hands at that point, can deduct unpaid invoices as business bad debt.

#Fixed expenses examples registration#

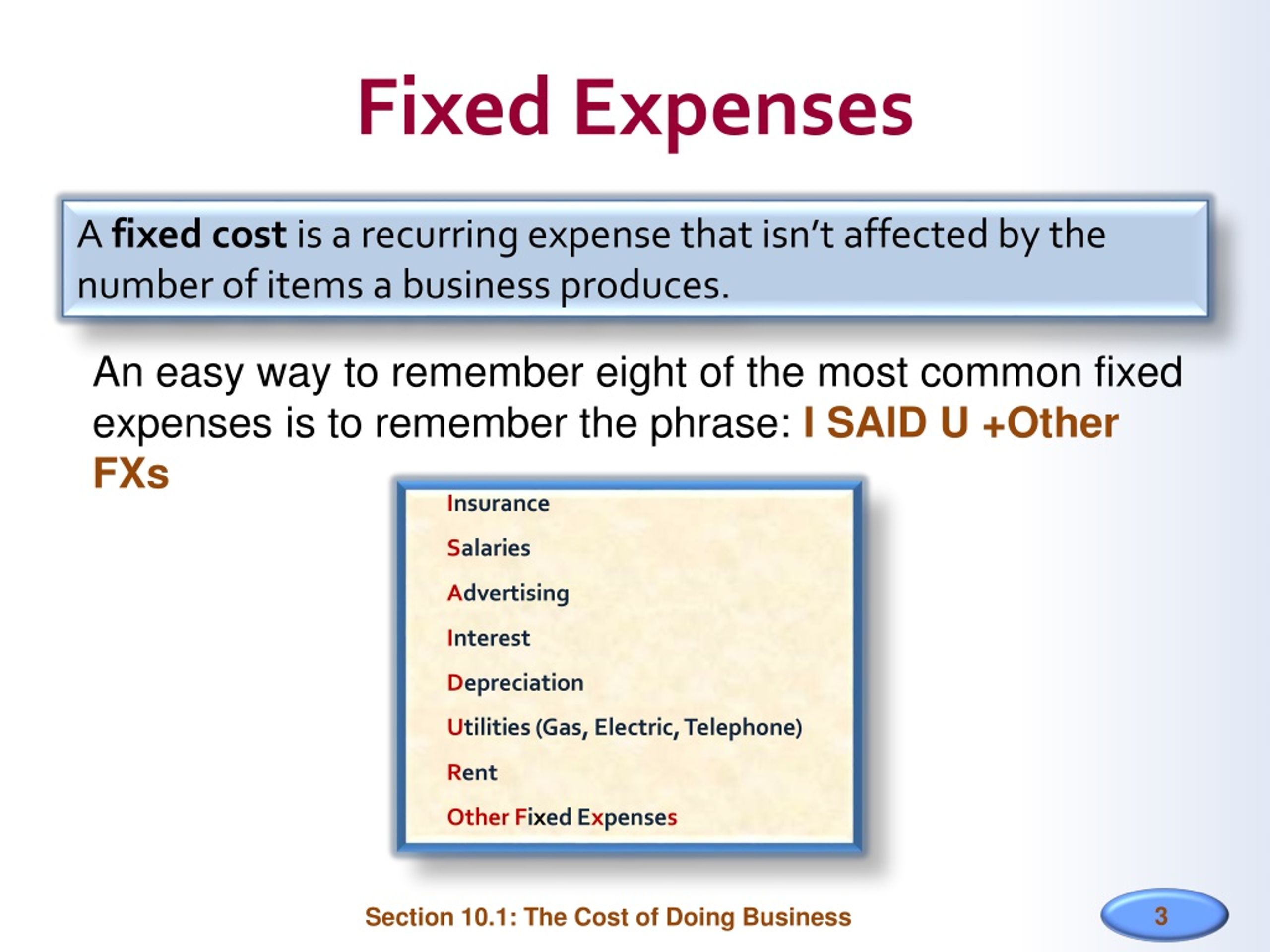

Relevant materials, books and registration fees for you and your employees are tax-deductible. This can include courses for continuing education or seminars to stay current on industry trends. You may even deduct spending on a PR campaign. Examples include fees paid to advertising or marketing companies to produce promotional materials, billboards, brochures, posters, websites and social media images. This covers the cost of items and services to directly promote or market your business. 36 Business Expense Categories for Small Businesses and Startups Add to this industry-specific categories, such as R&D costs or spending to seek VC funding. Speaking of, it’s worth spending time with a financial adviser to understand the types of expenses you can and can’t include in a specific category.īelow is an example small-business expense categories list that applies to most companies, outlining what’s included and how you can qualify for a deduction. You’ll also save significant headaches for your bookkeeper or tax preparer. What Are Business Expense Categories?īy developing expense categories that fit your business and recording and organizing expenditures as you go, you’ll find it easier to get all the deductions you’re due. The IRS also suggests distinguishing usual business expenses from categories that fall under the cost of goods sold (COGs) and capital expenses to ensure accuracy, since some business expenses cannot be deducted in the year they’re incurred. Otherwise, the IRS may determine your business is a hobby and disallow expenses. Even if your small business faces financial problems and doesn’t actually generate a profit, the intent needs to be there. Those “ordinary and necessary” expenses must be incurred in an organization motivated by profit. Start by reviewing Internal Revenue Service Publication 535, which discusses the deductibility of common business expenses and general rules for filing your taxes. Which expenses may be written off varies depending on the nature of your business. What Is a Tax-Deductible Business Expense? That makes it well worth the time to organize your spending so your business takes all legitimate write-offs, creates an effective financial plan, pays the proper amount in quarterly taxes-and doesn’t need to sweat an audit. As long as an expense is “ordinary and necessary” to running a business in your industry, it’s deductible. Given that broad mandate, the IRS doesn’t provide a master list of allowable small-business and startup deductions.

As long as the space is exclusively used for business, you can deduct $5 for every square foot, up to $1,500.īusiness expenses are the costs of running a company and generating sales. Or maybe you shuttered your office and started running your company from a spare room. It may seem time-consuming to keep a log separating business and personal use, but you’re losing out on close to $600 in deductions. But some easy moves could significantly lessen your tax bill.įor example, say you’re putting 250 miles per week on your private vehicle to get products out to customers. Sure, you’re focused on customer service and improving your products and services. East, Nordics and Other Regions (opens in new tab)Īttention to expense deductions may not play a prominent role in the financial planning process for small businesses and startups-and that may be costing them.

0 kommentar(er)

0 kommentar(er)